Most of us begin our working lives under the direction of someone else, whether an individual or an organisation, who tells us what to do.

Parents and teachers often advise us to “work hard and get a good education” so that we can secure a “good job” with a “good pension.”

However, they are usually vague about what this good job might be, as their experiences are often outdated.

Unfortunately, their idea of a “good job” is increasingly rare today. A key feature of such jobs was their reliability and the security they provided, often referred to as “job security.” This concept implied a steady income, even during slow periods, and a “good pension” as a reward for loyalty upon retirement.

The notion of a “good pension” is also becoming outdated. Few companies today have enough funds to offer generous pensions to former employees. Even the government and other public sector organisations, once exceptions, are now lowering expectations due to shrinking pension funds and the inability to rely on taxpayers to cover shortfalls.

The era of the “good job” and “good pension” has passed.

In the past, large commercial and public sector organisations could offer lifelong job security and a good pension for loyal employees. Today, these organisations either no longer exist or have significantly downsized.

Now, the reality is different: you can work and earn when there is work, but when work dries up, you face redundancy and must find other ways to support yourself and your dependents.

A New Approach

The modern world demands a different approach to work. Instead of relying on an employer for work and income, we need to adopt a more independent mindset. Today, self-reliance is essential, and it’s crucial to “work for yourself.”

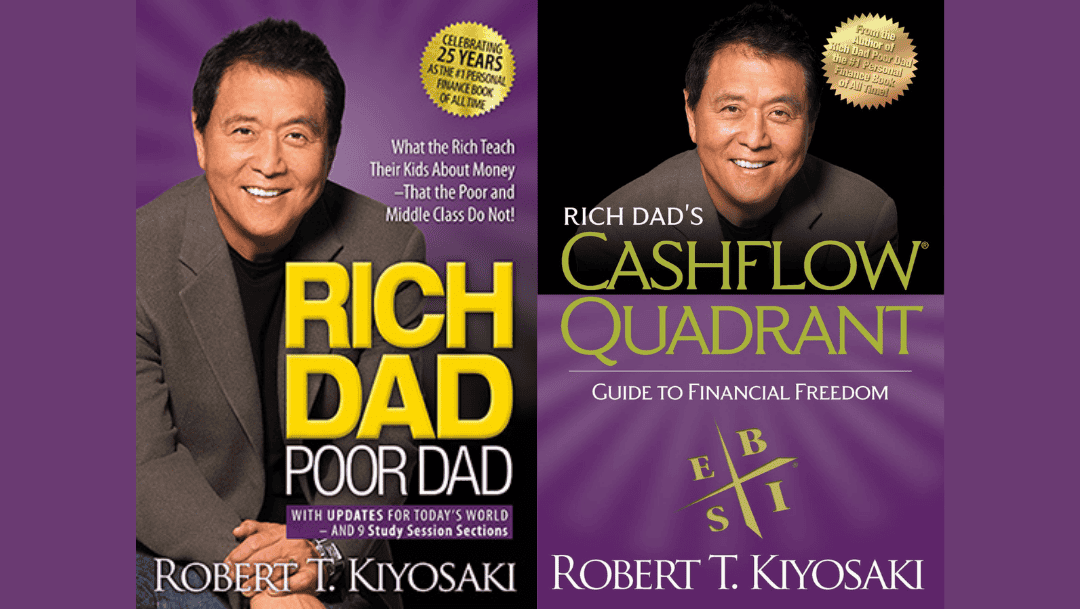

This shift has been clearly outlined by a financial thinker named Robert Kiyosaki. His most famous book, Rich Dad Poor Dad, offers a semi-autobiographical account of his financial education. His follow-up book, The Cashflow Quadrant, is less well-known but equally important.

Kiyosaki describes four ways to generate the cash we all need: being an employee, being self-employed, owning a business, or investing. He presents this not just as a set of options but as a journey, beginning as an employee and culminating as an investor.

The book provides detailed insights into each of these four stages and is worth reading as it offers a roadmap for financial survival and security in our global economy. It’s evident, even from this brief overview, that starting to work for yourself early on is key to this journey.

However, The Cashflow Quadrant does not provide a how-to guide. To truly change your thinking and attitudes and navigate this path, you would need to read Kiyosaki’s other books—about ten in total.

The best way to start is by finding a mentor, someone who has successfully started their own business.

Click to go back to Money and Wealth